Transformers One Trailer, Release Date, Cast & News to Know

The trailer for Transformers One has been released, giving viewers a glimpse at the early days of the Autobots and Decepticons in the animated film.

The trailer for Transformers One has been released, giving viewers a glimpse at the early days of the Autobots and Decepticons in the animated film.

Sailor Moon Crystal wasn't a remake of the classic 1990s anime series, but it was a much more accurate representation of the manga's storyline.

CBS has confirmed the future of the CSI sequel series.

Fullmetal Alchemist: Brotherhood's fifth episode "Rain of Sorrows," raises the stakes for the brothers – and proves Alphonse's strength.

Noah Centineo took over the role of Jesus on The Fosters originally played by Jake T. Austin. What was the reason for the change?

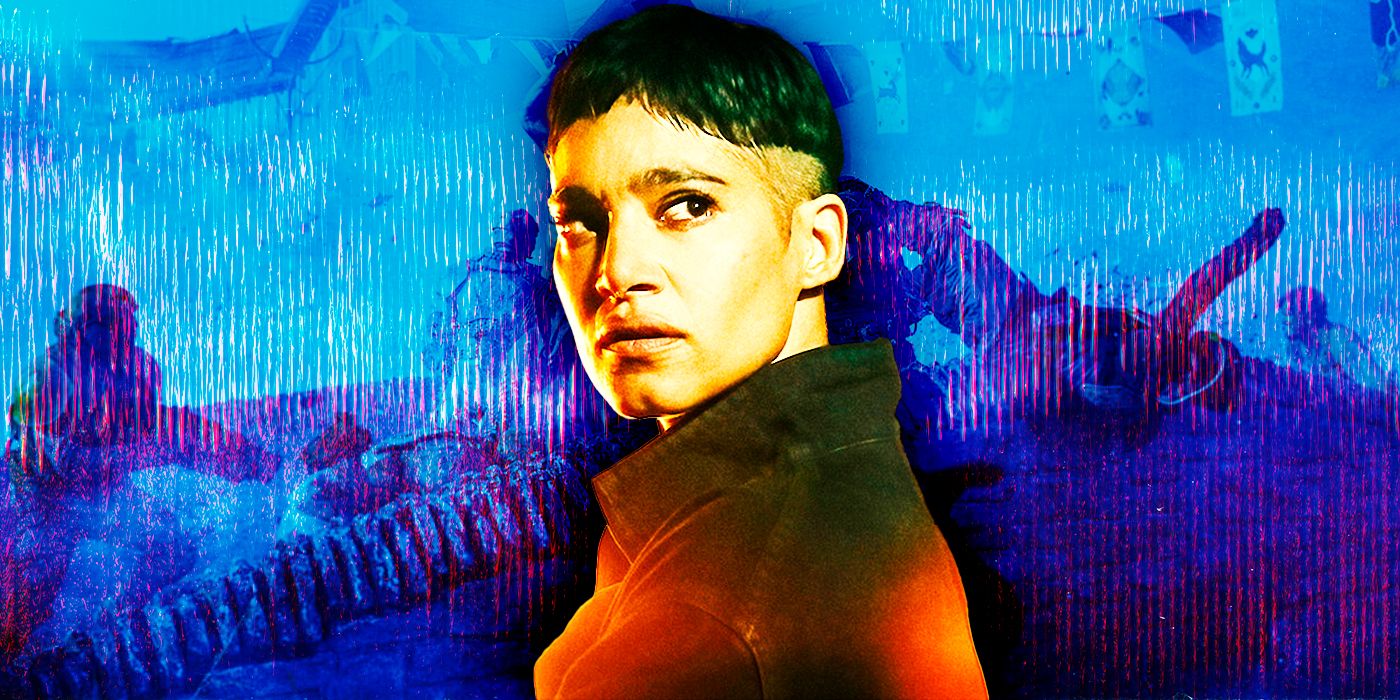

Actor Sarita Choudhury shares a response to fan theories about Moldaver following Fallout’s intense season finale.

The episode titles and runtimes for all six episodes of the Sonic the Hedgehog spinoff series, Knuckles, starring Idris Elba, have surfaced.

Ichigo Kurosaki started out a normal human, but gained an extensive repertoire of skills and abilities that came almost naturally to him.

Kenan Thompson reveals how he kept it together while all of his co-stars were breaking in the viral Beavis and Butt-Head skit.

Dune: Messiah gets an encouraging update from franchise director Denis Villeneuve as the threequel ramps up development.

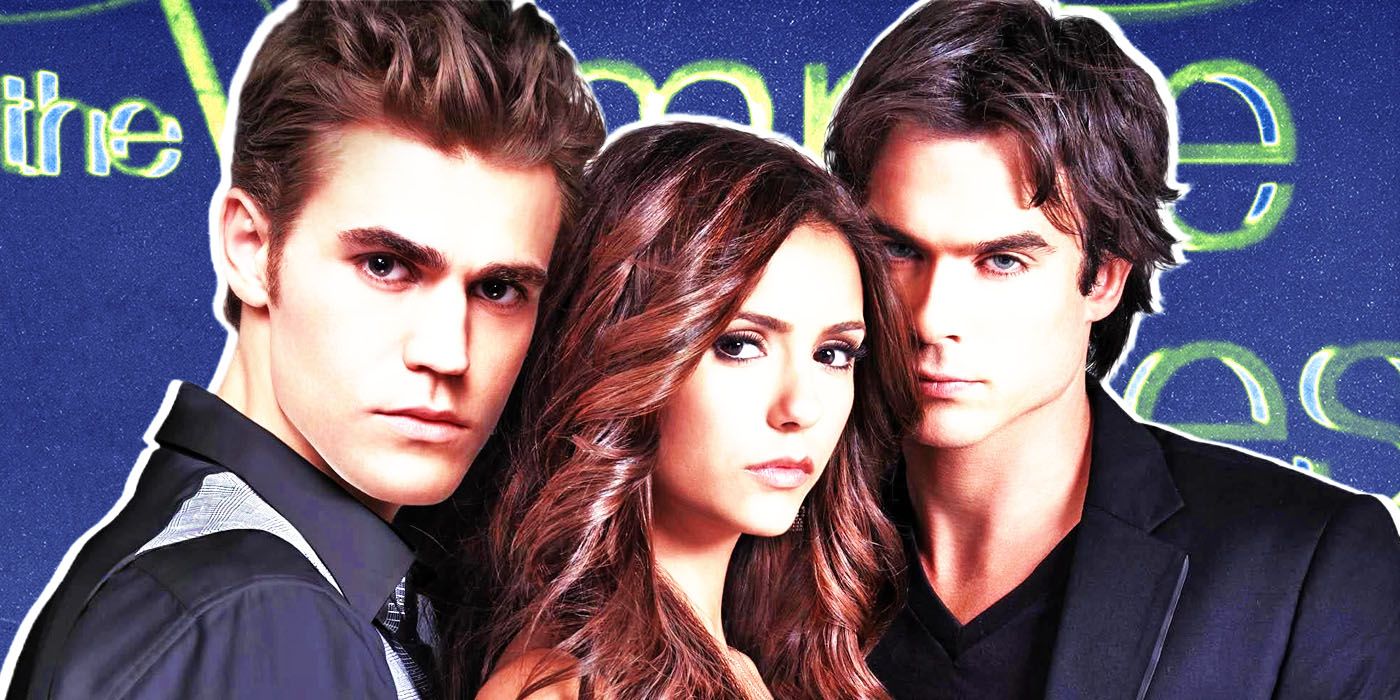

The Vampire Diaries have many characters that act as protagonists. While all points would lead to Elena being the focus, it's actually someone else.

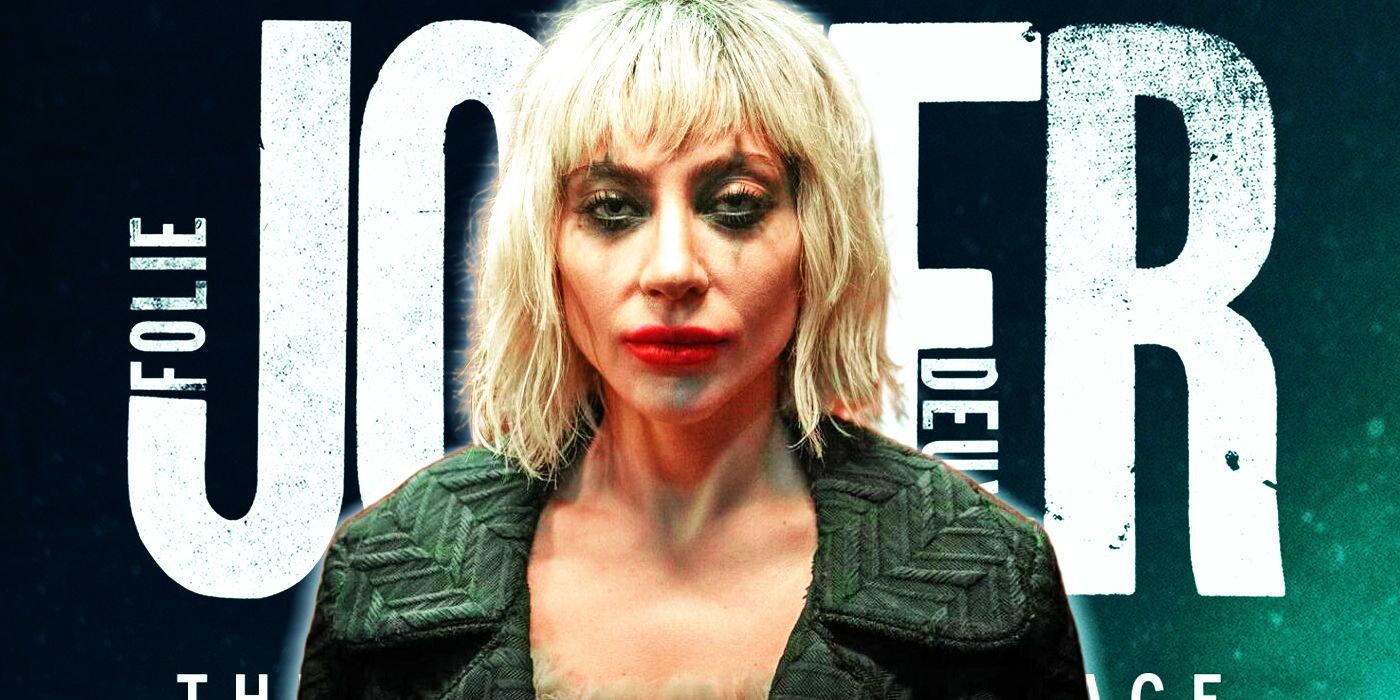

Joker: Folie à Deux has a tough act to follow and high expectations to meet as Lady Gaga takes on the role of Harley Quinn in the upcoming musical.

Rebel Moon - Part Two: The Scargiver sets an unfortunate record as the space opera sequel officially debuts on Netflix.

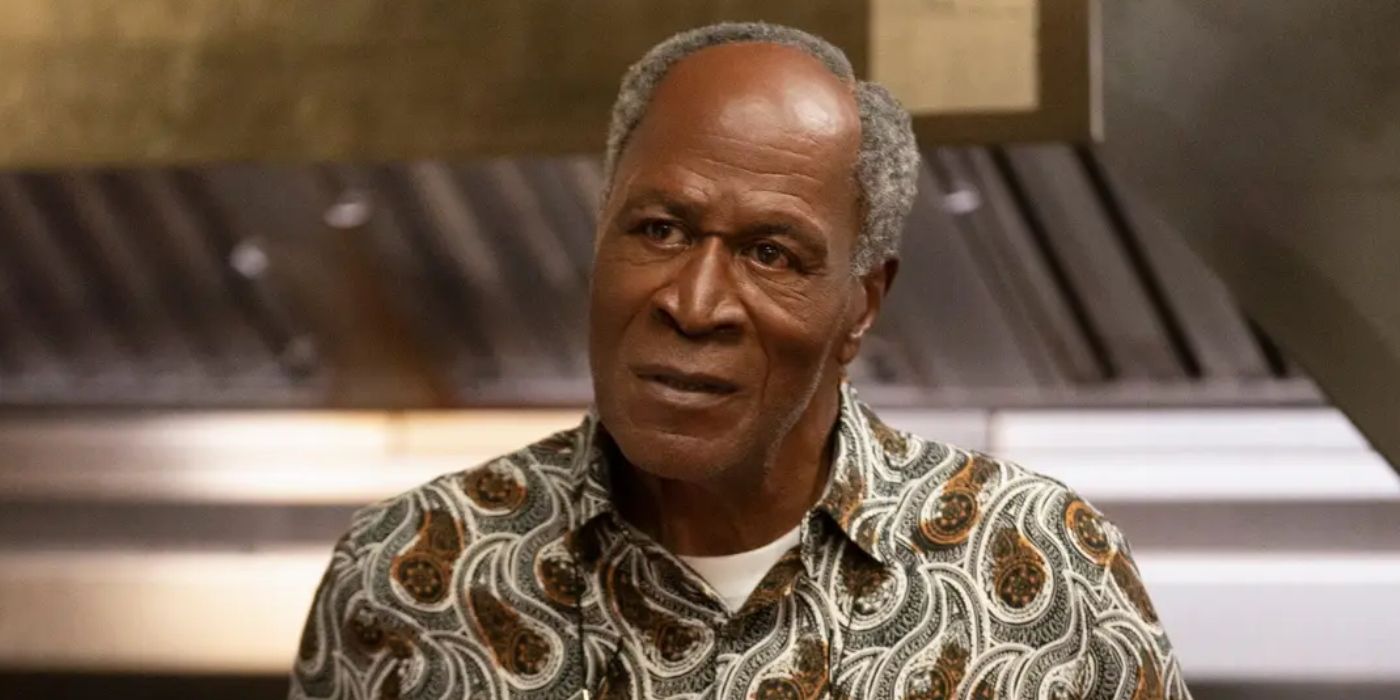

Good Times star John Amos joins Alias and Nickelodeon stars as part of the cast for Stephen Amell's Suits: L.A.

With dream sequences and seemingly unrelated storylines, The Leftovers Season 1 isn't easy to follow, but the season finale ties all loose ends.

An award-winning Nintendo DS exclusive horror survival video game is now available on both PlayStation 4 and PlayStation 5.

The anime association NAFCA warns of a dystopian future of AI "monsters" that infringe on creators' copyright and their creative intentions.

Noah Hawley's upcoming Alien series on FX adds another cast member and reveals just how many decades it is set before the original movie.

The Harry Potter franchise has many tales that show magic in a new light. But fans of the series should get excited for another magical movie.

Batman v Superman: Dawn of Justice director Zack Snyder talks about the origin of the "Martha" scene, which was about getting to Batman.

Dune: Part Two helmer Denis Villeneuve talks about the infamous and viral popcorn bucket promoted ahead of his hit sci-fi flick.