What Happened To Wolverine's Universe In Deadpool & Wolverine?

The latest trailer for Deadpool & Wolverine suggests that this version of Logan failed to save his universe. What happened to Wolverine's world?

The latest trailer for Deadpool & Wolverine suggests that this version of Logan failed to save his universe. What happened to Wolverine's world?

Dune: Part Two was a massive success, but there are some challenges for Dune 3, Lady Jessica actress Rebecca Ferguson notes.

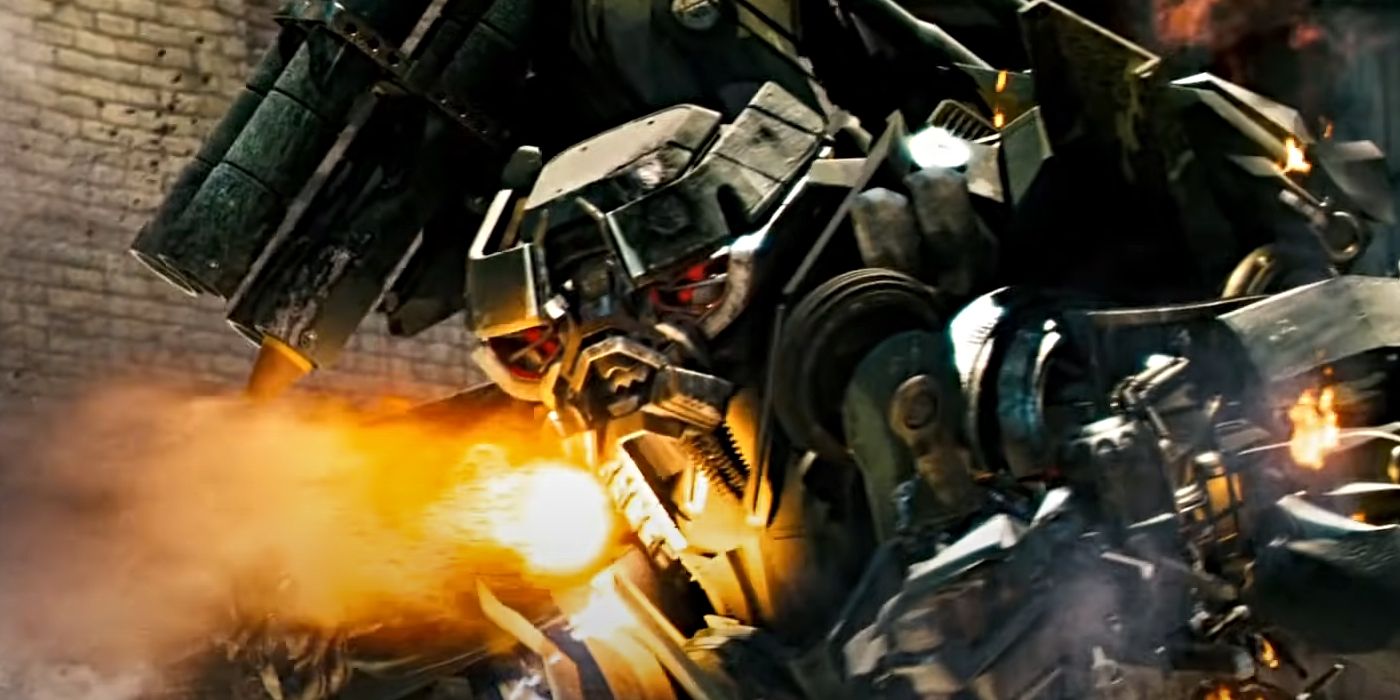

The Decepticon Brawl is the latest (and last) character to join the movie-based section of the high-end collector's line, Transformers: Masterpiece.

Criminal Minds: Evolution reintroduced many original characters save for the fan-favorite Spencer Reid. But why did the actor behind Reid not return?

Comedian Jerry Seinfeld shares that he doesn't regret how his beloved NBC sitcom ended before revealing his favorite series finale of all time.

Ant-Man and the Wasp: Quantumania reportedly cost an immense amount to create -- worsening the MCU threequel's financial woes.

Hot Toys has officially canceled a planned release of Ezra Miller's Barry Allen from The Flash.

Justice League: Crisis on Infinite Earths - Part Two has a harrowing finale that proves the true tyrant of this story has all bases covered.

Fist of the North Start fans can cut like Kenshiro and Rei by supporting the Kickstarter campaign for the classic franchise's themed kitchen knife.

Thirteen Ghosts features plenty of terrifying ghosts. Each has its own traits and unique backstories that are hardly explained in the movie.

An original Pirates of the Caribbean star opens up about how he joined the beloved franchise and what he thinks about Disney rebooting the series.

Helen Mirren and Pierce Brosnan have joined Harry Potter director for an upcoming murder mystery.

Actor Isabela Merced reveals what she loves about James Gunn's Superman directing style and why she "would be honored" to be the face of Hawkgirl.

Analysis of leaked cloud server files reveals that a North Korean animation studio may have worked on an upcoming Summer 2024 anime despite sanctions.

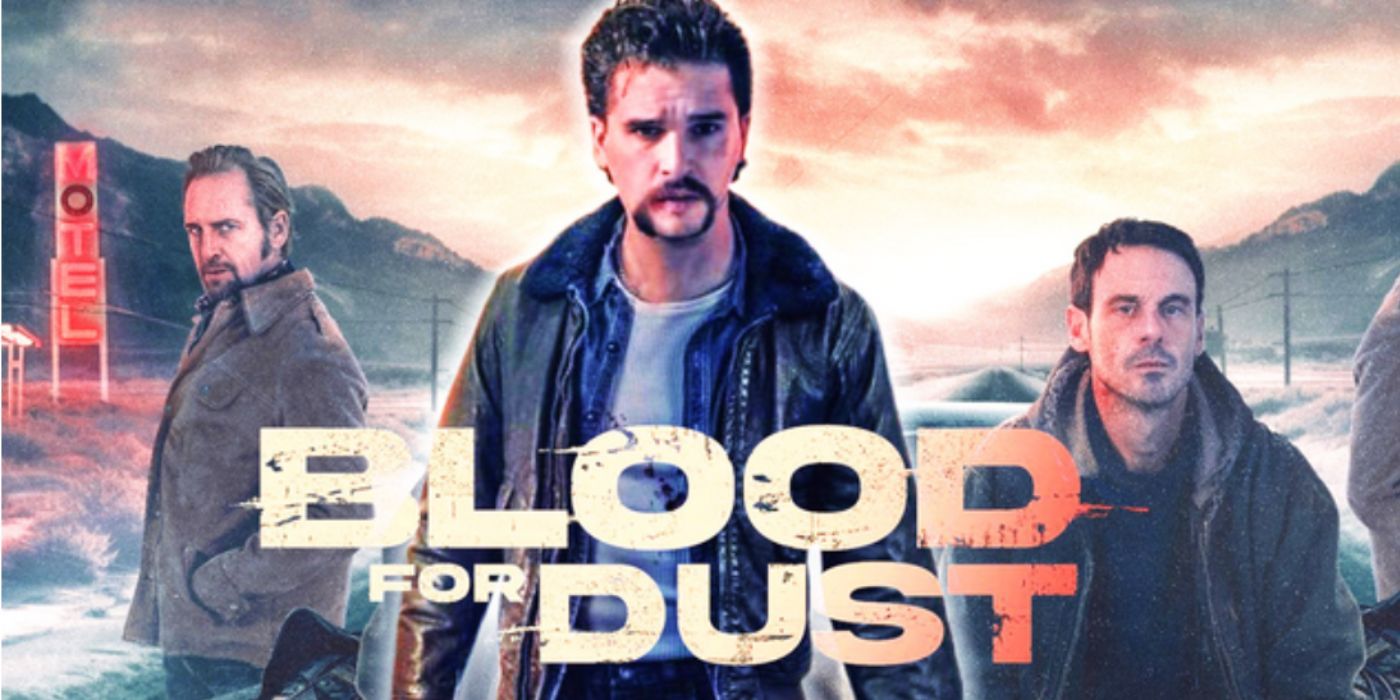

Starring Kit Harington, Blood for Dust contains strong performances and appealing cinematography, but the story is dull and disappointing.

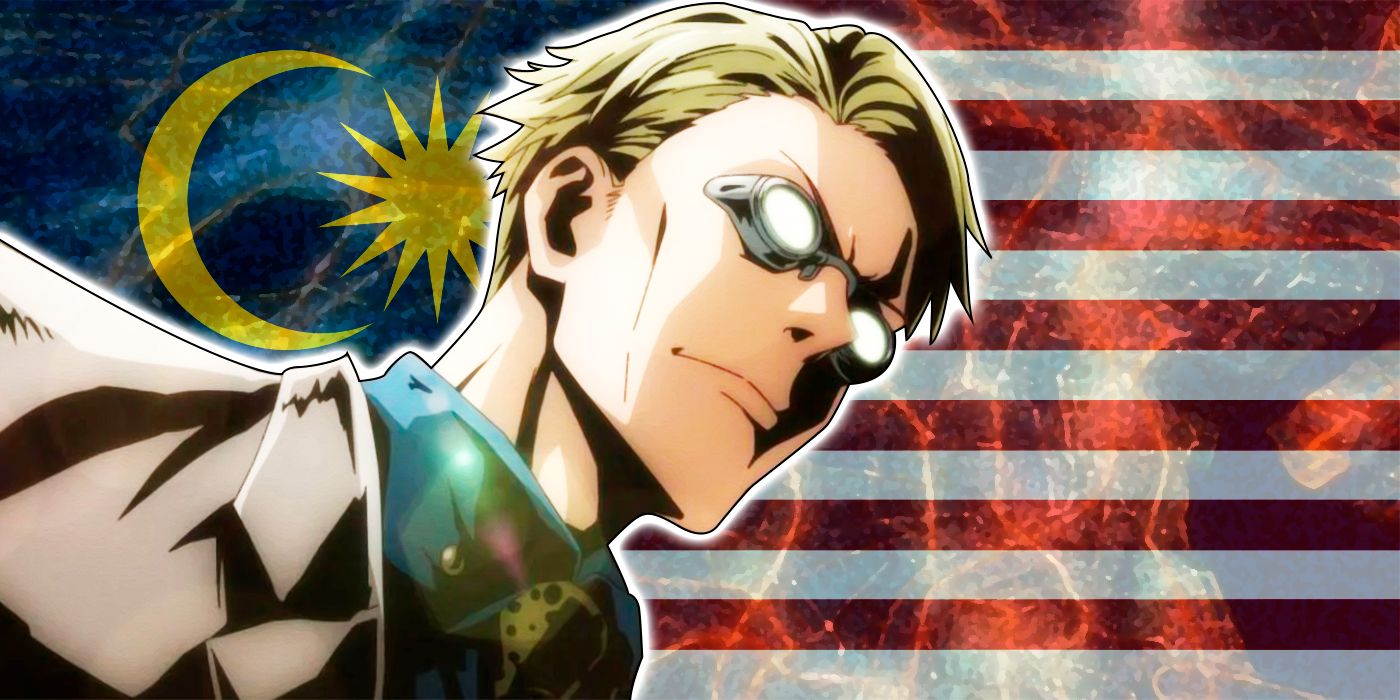

The Malaysian government is now four months into copyright negotiations with Jujutsu Kaisen's creator to construct a Kento Nanami memorial.

Netflix's The Grimm Variations updates fairly tales for modern sensibilities - while giving them a much darker tone than the Grimm Brothers originals.

Max Greenfield would happily reprise his role as Schmidt in the hit comedy series, but only when the time is right.

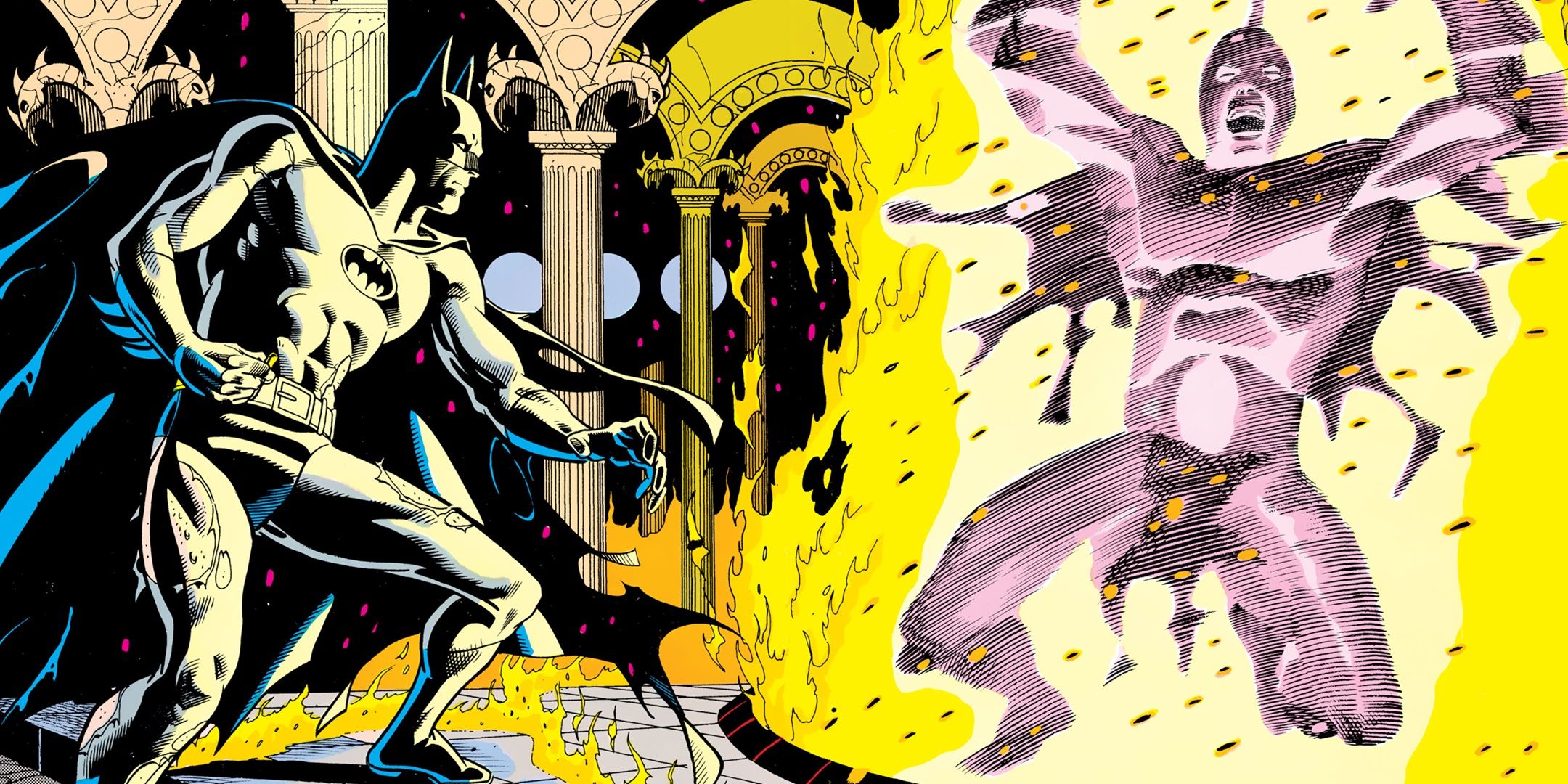

One of Batman's lesser known moments of badassery took place when he faced Despero with Justice League Detroit for the fate of the world

The Go! Go! Loser Ranger! anime and manga perfectly subvert Power Rangers and Super Sentai, upending their basic concepts for a cynical satire.

The Academy Award nominee would star and produce in the film adaptation of the hit video game.